Work With Us

Work With Us

A Fresh Approach to Wealth Management

Financial Planning

Let us help you take the worry and hassle out of financial planning

Business Planning

Let us help you create more value and freedom from your business

Investment Management

Let us help you invest for your most important life goals.

Risk Management

Let us help you protect the money you’ve saved and earned for your family and your legacy.

A Fresh Approach to Wealth Management

Financial Planning

hassle out of financial planning

Business Planning

and freedom from your business

Investment Management

for your most important life goals.

Risk Management

A Comprehensive Approach to Personalized Wealth Management

Going Beyond Products: Putting Life Planning at the Core of Your Financial Journey

(Bottoms-Up Approach)

(Top-Down Approach)

At IPWA, we believe in taking a holistic and client-centric approach to wealth management, which sets us apart from the traditional bottoms-up approach followed by the rest of the industry. While the conventional approach focuses primarily on products and investments, we recognize that true wealth management extends beyond financial assets.

Instead of starting with products and working our way up, we begin by understanding your unique life goals, aspirations, and values. This top-down approach puts “Life Planning” at the forefront of our process, acknowledging that your wealth is a means to achieve a fulfilling and meaningful life. We take the time to listen, understand your priorities, and align our strategies accordingly.

Once we have a comprehensive understanding of your life goals, we move to the “Plan” phase. This involves developing a customized and integrated wealth plan that encompasses various aspects of your financial situation, including investment strategies, tax planning, estate planning, and risk management. Our experienced advisors work closely with you to create a roadmap that reflects your specific needs and aspirations.

Finally, the “Products” section of the traditional approach is integrated into our process but not as the starting point. We leverage a wide range of investment solutions and financial products to support and execute your personalized wealth plan effectively. By prioritizing your life goals and creating a comprehensive plan, we ensure that the products we recommend align with your objectives and serve as tools to help you achieve long-term financial success.

By adopting this client-focused, top-down approach, we provide a more meaningful and comprehensive wealth management experience that goes beyond simply managing your money. We are dedicated to building lasting relationships with our clients and helping them navigate their financial journey with confidence and purpose.

3 Outcomes We Can Deliver to our Clients:

-

All of your financial choices (goals) will be aligned with your most important goals and most deeply held values.

-

You will have your financial house in order, and we will help you keep it that way – FOREVER

-

We will provide you with a Worry-Free and Hassle-Free Wealth Management Experience Available because of our multi-family office style approach.

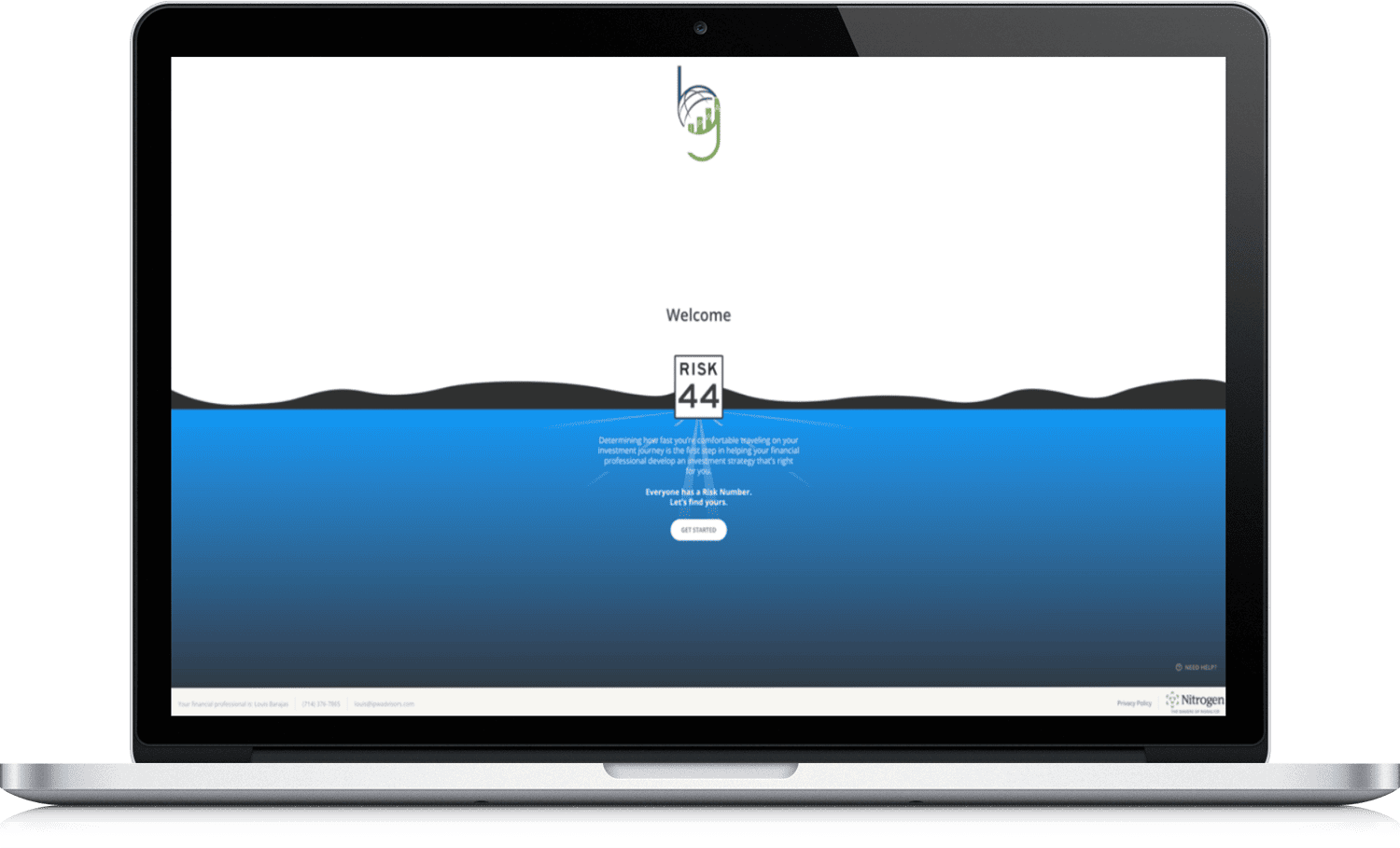

What's Your Risk Number?

Get your free portfolio analysis by simply clicking the button below!

Define Your Risk Number

Align Your Portfolio

Define Your Retirement Goals